Where is his agency here?

Get a second box that is not broken. Put it next to the broken box.

Let Sencha decide which box to keep. He’ll choose the one he wants. Discard the other one.

Where is his agency here?

Get a second box that is not broken. Put it next to the broken box.

Let Sencha decide which box to keep. He’ll choose the one he wants. Discard the other one.

Abstract: Brown corrugated cardboard is the symbol for consumerism as global trade ships goods to one side of the equation while shipping the externalities to the other. The artist’s view on capitalism is clearly depicted here with an example of a futile attempt at attacking consumer culture. The tooth punctures are a visceral and unbridled reaction against from one that is powerless against the powerful.

I have it on good authority that Drop Bears routinely steal phones after 5pm and uncharacteristically return them by 8am the next morning.

anakinandpadme.jpg

Anakin: “Sign a contract and serve 6 months or until death”

Padme: “Whichever comes first, right?”

Anakin: …

Padme: “Whichever comes first, right?!”

Correct me if I’m wrong. I know that Canadian home prices are bonkers, especially in large cities like Vancouver or anywhere in the GTA (are the Quebecois also having this trouble?). However, the problem with Evergrande isn’t just failure of this company reduces home prices (which is where lots of Canadian savings resides), but Evergrande had taken deposits for tens of thousands of homes it never built or never completed.

So while the value/sale price of a home in Canada may be falling. At the end of the day it still does have value monetarily, and still serves a vital function of housing a family.

China’s situation with Evergrande means the money paid for the house by the owner simply evaporated with no possibility of a refund and the house doesn’t exist because it was never built (or never completed). So to me the China situation looks significantly more dire.

is a symptom of a deeper malaise in the Chinese real estate market.

Its even worse than that because retail investors in China use real estate as their primary investment vehicle. Where as someone in the USA might put money in a 401k for retirement or a brokerage account for investing, those don’t exist (in the reliable way) in China. So many regular people’s nest egg is tied up in real estate. So this isn’t just the real estate market getting wiped out, its millions of working class people’s life savings just evaporated.

This vigilance against corruption (as part of an effort to project the message outside the country) might end up becoming a lasting benefit long after Russia has been defeated, Ukraine is a member of the EU, and NATO.

I wish they could have stolen the data before they wiped it so it wasn’t lost, but that’s a lot of data to swipe.

Ukrainian hackers could cryptolocker it and exchange the keys for Ukrainian POWs.

There are a number of “levers” that a nation has to influence its economy. Here’s a really simplified version. The biggest lever on one side has low interest rates, and when you swing it to the other side is high interest rates.

When you want your economy to “heat up” or increase in activity, you swing the lever to “low interest rates” - Depositor’s (you, me, and corporations) money sitting safely in banks now earns a lot less interest. So a company is not making very much money just letting it sit. Companies will look for things they can remove their money from bank for and invest in (new businesses, hire new workers, expansion, research & development on new products). This ultimately means the money is spent to buys things. If everyone is doing this same thing, the price for things to buy goes up. There are more buyers than product. This is inflation, which too much, is bad for your economy. So what do you do when you now have high inflation and the value of your money is going down (because it takes more money to buy the same thing you bought before)?

When you want your economy to “cool down” or decrease activity, you swing the lever the other way to “high interest rates”. Companies see they can get great returns just by stuff their money in a bank and it is a super safe investment. Suddenly all of that spending that was happening in your economy to buy things for expansion, starting new business, or hiring additional workers dries up. The rise of prices slows, and given enough time, halts.

So who moves the lever? How do they know when to move it? Which side do they move it to? How long do they let it sit at that setting before they move it again? How do they know when to do that second move?

Federal bankers who are economists that watch for market trends and economic indicators. It is much more art than science. When they do their job well, you don’t even notice. Things just get good. When they don’t do well, your entire country feels it and daily life is massively affected. People lose jobs, houses, and have trouble feeding themselves.

For those not familiar with this language a “basis point” is .01 of a percentage point. So in this example:

“Turkey’s central bank on Thursday hiked its key interest rate by another 250 basis points”

…would mean an interest rate hike of 2.5%.

To put that into perspective, the USA’s Prime Interest rate (which mortgages, bank loans, and credit card rates are derived) is currently 8.5%. If the USA raised the Prime Interest rate by 2.5% making Prime Interest rate 11% there would be huge HUGE economy impacts. Entire industries overnight would become nonviable. The slow home sales right now would grind to a near absolute halt. Millions of Americans that are servicing revolving debt would see their monthly payments see large increases.

I don’t even get how the op is supposed to work.

The only way I could see this as a success for Russia is if it was a counterintelligence operation to expose a mole in their organization. Depending on how high value the mole is/was it might be worth trading an IL-76 for. Keep in mind, I don’t think that is what happened here. Russia is making too many dumb mistakes for this to be any kind of coordinated plan on their part.

It is much MUCH more likely that Ukraine got smarter with their resources and/or took a risk about locating a functional AA missile battery close enough to the Russian border to make this happen. We saw it with the A50 shot down over the Sea of Azov a week or so ago. Russia getting lazy and losing rare and valuable aircraft is getting much more common.

Can someone explain to me why this shootdown is even news instead of a statistic?

Sure can!

Lots of good news in this!

Interestingly this has been in the works for almost a decade. Lots of good information here

Some good bits:

Seeing as 6 of Ukraine’s largest reactors are under Russian control in Zaporozhye, and that a good chunk of Ukraine’s national revenue comes from the export of electricity to Europe, the need to get more capacity online is apparent.

And not just Turkish ownership of F-35 jets, but if I remember correctly a production line was going to be set up in Turkey as well employing Turkey’s citizens in profitable high tech work.

All that was manageable but the Chinese economy isn’t what it used to be and now it is finally time to cut bait.

Agreed, and that “economy” point is two different, but important pieces:

Both of those are history. There’s one other element that was attractive to foreign investment that is also gone and coloring the decisions of these companies.

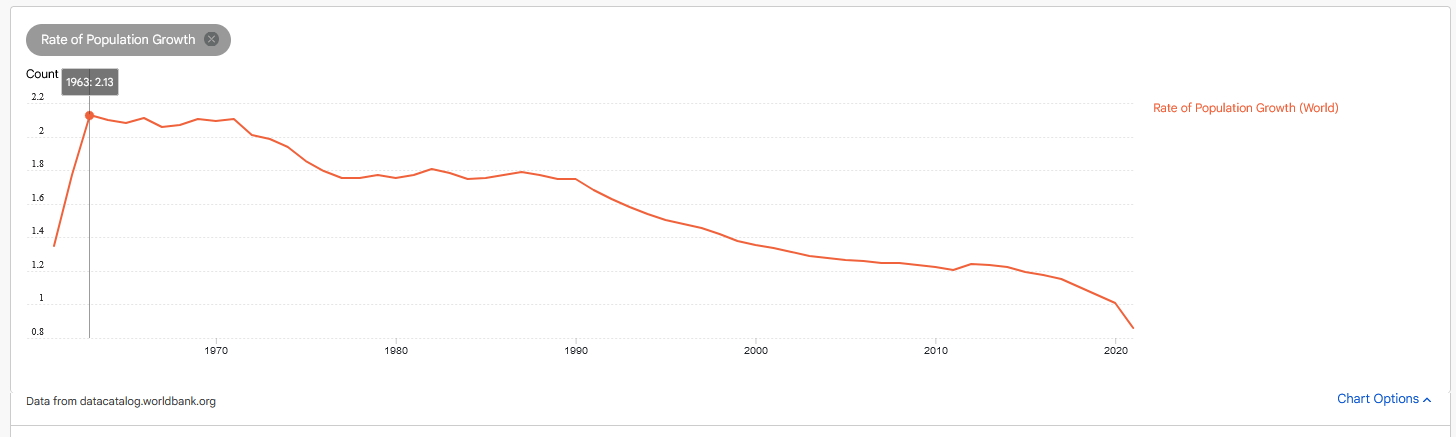

If the growth was sustainable, how does it meet the definition of “overpopulate?” Further, while the world population is on the rise for now, the rate of growth has been slowing since1963:

Took my brain a second to process “Poltava” not “Poland”. I was already thinking “ah shit, this is it now”.

There’s Polandball comic in this somewhere.

Domestically produced in North Korea.

There was a picture showing the North Korean shells next to Russian and Chinese. Not only were the manufacturing tolerances no where close to Soviet Standards, but the date codes on the shell showed manufacturing post Soviet collapse.

I actually see this as good news for Ukraine.

It shows that Russia has exceeded its own capacity for producing munitions and having to reach out of others for such a basic product. Further, reports from Russian soldiers using North Korean artillery shells report how poorly they’re constructed which makes them many times ineffective, but also dangerous to Russians firing them.

Performance is inconsistent from one shot to the next, which is horrible for something you have to fire again and again to zero in on your target. Other shells are simply exploding in barrels damaging Russian guns and wounding Russian operators.

I hope Russia switches exclusively to North Korean shells.

Clearly didn’t clean the lint filter in the dryer. Your furball is huge!